Small Business Bookkeeping – Everything You Need to Know

No small business can exist without some form of bookkeeping. Bookkeeping involves sorting, recording, and classifying all the financial transactions in your business.

It’s keeping track of what your business spends and what your business receives. People used to keep track of these sums in books called ledgers, which is why it’s referred to as “bookkeeping.”

Now, Modern software can manage all of that bookkeeping and accounting more quickly and accurately by relying on bookkeeper software.

What’s in this article?

- Bookkeeping for a small business – what do they entail?

- Small business bookkeeping templates: should I use them?

- How to choose the “right” bookkeeping template?

- How do I manage the bookkeeping for a small business?

- Examples of bookkeeping for small businesses

- Free small businesses bookkeeping solutions

- 5 Top bookkeeping tips for small businesses

- Should I do digital or manual bookkeeping for my businesses?

- How can I use Excel for my small businesses bookkeeping?

- Should I have “all in one” bookkeeping tool?

- Should I use bookkeeping service?

- bookkeeping services for small businesses

- The cost of bookkeeping services for small businesses

- Conclusion.

Bookkeeping for a small business – what do they entail?

Bookkeeping for a small business tends to require less intensive accounting systems. A small business owner is generally concerned with fewer sources of income and expenses.

Smaller businesses will also often have their focus more on shorter-term growth and expansion. This means that the software system they sign up for will be designed to suit their needs.

Small business bookkeeping templates: should I use them?

Absolutely. If you want to profit as a business, you are going to need to stay organized. You will need to know all the information on your business transactions, products, and services your business offers, as well as keeping track of expenses and revenue. To stay organized.

Premade templates make handling your expenses or business accounts simpler by providing you with specific financial fields to fill.

Working with templates makes small business accounting much more straightforward.

It gives business owners an easily understandable record of business and personal expenses that they can provide to the IRS.

Finding the proper template to track your business finances will help you run your business with the peace of mind that comes with knowing your accounts are well managed.

Keeping your records all in one place, recorded in an organized format, will keep you from finding yourself scrabbling at the end of the year to find every scrap of paper to try and enter your tax returns.

Many software options offered have a simple data entry that handles accounting or bookkeeping for a business.

How to choose the “right” bookkeeping template?

Just by searching “Bookkeeping Templates,” you will find an overabundance of free software options for small businesses.

Many sites will have free balance sheets to help you keep track of your bank account and credit card statements. Many more will have slots to enter credit card expenses, balance sheets, and simple entry accounting.

Excel, for instance, has some amazing Bookkeeping Templates. These templates are well designed to manage basic bookkeeping tasks using Microsoft, and they are available for free to download for business or personal use.

Search online for a “free accounting template.”

How do I manage the bookkeeping for a small business?

The best way to keep your books when running a small business is to follow certain “rules” when it comes to bookkeeping, and doing so increases the likelihood of your business profiting.

The choice to integrate bookkeeping apps into your business is a choice that has become practically mandatory for bookkeeping and accounting. Business owners can gain a lot more and learn more about their companies by relying on online software.

Trusting an online service has the added benefit of making all of your information cloud-based. Once your information has been uploaded to the cloud, it is nearly impossible to destroy or lose and accessible to you wherever you want.

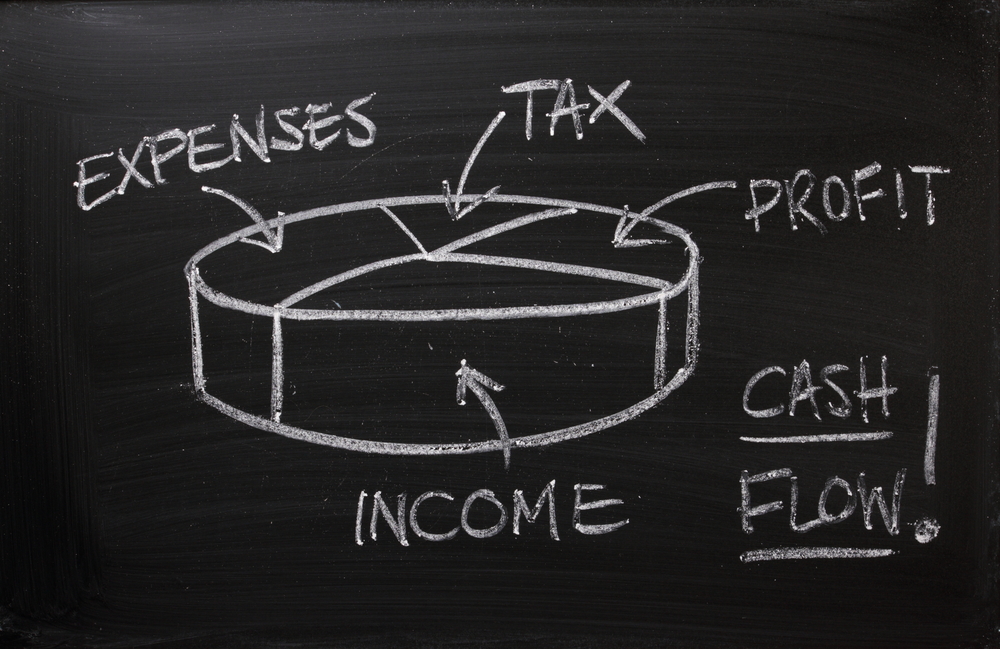

You can share your cloud-based information with your bookkeeper, check your bank statements wherever you are, whenever you feel like it, and keep track of your cash flow in real-time. As a business owner having such control over your financial information is an invaluable service.

Most free accounting systems and bookkeeping software exist. Take some time to check out the various options.

Buying accounting software for your business is cheaper, faster than relying on a human bookkeeper. It provides more reliable financial statements by helping you avoid human error in the accounting and bookkeeping your accounting system needs to do to keep track of your bank accounts.

Keep records of every payment you make or that is made to you. You want to keep track of your cash flow, in and out. As a business owner, you can rely on software for small businesses or templates to keep your financial reports.

When choosing your accounting software, you’re going to want to pick something with certain basic accounting features. Your choice should allow you to manage a balance sheet, do your basic bookkeeping, allow for simple information entry of your revenue. It should also be able to help you manage your tax returns. The service should also provide a chart of accounts and accounting features and to help you keep track of your transactions, both online and in person.

Good to know

Most accounting software for small business owners offers free trials to give you a chance to try them out before making your subscription. Try the system out and see if it suits your needs. Check its online features and bookkeeper services to ensure that the accounting software you choose suits your business style and your personal way of accounting.

Once you choose a single accounting method, be sure to use the bookkeeping methods offered. While some software handles your receipts automatically, others don’t. Be sure to know which system your software relies on.

It is crucial to keep strict deadlines. As a small business competing with other small businesses, you want to set your service apart.

Bookkeeping software is beneficial when keeping deadlines. You can use your phone or google calendar to create alerts as to when a deadline occurs. This small touch will also make sure you have clear business records, sales tax payments, income tax, fees, and shipment costs.

You will want to keep track of your cash flow as it will significantly simplify things come tax season. Having your business expenses and your expenses saved in the exact location lets you view your bank account balance sheet to keep track of expenses and profits.

If you don’t track your financial reports, you’ll have no way of knowing whether you are doing poorly or well.

No matter how you decide to deal with your business’s financial health and its accounts, you will want a bookkeeping system that gives you what you need for your business. Keeping accurate financial records can make the difference between a profitable quarter and a loss.

Examples of bookkeeping for small businesses

Accounts Payable/Receivable

Think of this AP (Your Accounts Payable) as one that represents the money your business owes in the form of bills and invoices from vendors.

Accounts receivable (AR) is pretty much the exact opposite of accounts payable. If you sell a product or service and don’t collect payment immediately, your small business has receivables that you track in this account.

Accounts receivable is the opposite of AP is money due to your business from your customers. You must keep this up to date to send timely and accurate bills and invoices.

If you’re good at bookkeeping, then you’ll ensure timely payments, but most importantly, you won’t end up paying anybody twice.

Cash

A cash account is one where all of your business transactions pass through to track all of your financial activity. Plus, a cash account is arguably the simplest way to record cash payments, withdrawals, and deposits.

If they exist when your deal with it, get bank statements and as much financial information as possible on the transaction.

Inventory

All of the products your business has in stock need to be tracked and accounted for. This part is important because the numbers you have in your books should match by doing physical counts of the inventory on hand.

You can track inventory in two ways. Either periodically, you make a physical count of the inventory daily, monthly, yearly, or any other period that matches your business needs. Or whenever you make a sale – do whichever is easier for you and your business.

Loans

Let’s say you’ve borrowed money. It can be anything from buying equipment like computers, vehicles to help you get from A to B when on the job, or even furniture and other items for your business. These expenses fall under the loans payable account which tracks what you owe and what’s due for you to pay.

Purchases

The purchases account should also be something you look at when doing your books. This is where you track any raw materials or finished goods that you buy for your business.

It’s a big part of calculating the costs of goods sold, which you subtract from the sales account to find your business’s gross profit.

Payroll Expenses

If your small business has employees, this could be the highest cost and an account you can’t ignore when doing your books.

Keeping this account accurate and always up-to-date is vital for when you need to meet tax reporting requirements. A chart of accounts of employees you’ve paid will help you avoid disgruntled workers.

Retained Earnings

When you do your books, the retained earnings account tracks your company’s profits that you reinvest into the business and don’t keep for yourself or payout to other owners.

Retained earnings are cumulative, which means that they’ll appear as a running total of money you’ve maintained since your business started. In all honesty, managing this account doesn’t take much time, so make sure you track it to see how much your business has grown.

Many software companies offer free accounting software that will help manage the above financial business much more straightforward.

Free small business bookkeeping solutions

WellyBox – WellyBox is a leading expense tracker software used by over 5,000 small businesses. It’s one of the easiest ways to keep track of receipts 100% automatically, from discovering email and supplier receipts to entering data and creating expense reports at a glance.

Wave– A top free accounting software to consider from the start of your search is Wave accounting software.

QuickBooks – QuickBooks is an accounting software package developed and marketed by Intuit. QuickBooks products are geared mainly toward small and medium-sized businesses. They offer on-premises accounting applications and cloud-based versions that accept business payments, manage and pay bills, and payroll functions.

5 Top bookkeeping tips for small businesses

- Separate business and personal expenses. The last thing you want is your personal accounts and finances getting confused with your business accounts. The potential for personal financial loss and the risk from tax investigations should be enough to warn you from making this mistake.

- Get bookkeeping software. Some people are better at managing numbers than others. Thankfully, free bookkeeping software exists, to help you keep track of your business’s financial situation. Having the software will let you have peace of mind and help you avoid human error.

- Develop a budget. Know exactly what you’re planning on spending every month and plan for that number, be sure to calculate in a margin of error. Predicting your expenses will be accurate will help make sure you always have enough money to keep your bills.

- Choose an accounting method and stick with it. Make sure you and your employees are extremely familiar with it so that you can be sure you can trust your books when you see them.

- Please keep it simple by getting bookkeeping software. Some people are better at managing numbers than others. You should use free bookkeeping software to keep track of your business’s financial situation. Having the software will let you have peace of mind and help you avoid human error.

Should I do digital or manual bookkeeping for my business?

You can do both.

You can handle your base expenses on whatever software you choose and then print it out and keep track of your business accounting on your own. Just be aware that 80-90% of bookkeeping problems are caused by human error. You may also start by relying on paper for your business accounting and gravitate towards software for small businesses that you find online.

How can I use Excel for my small business bookkeeping?

Google offers several excellent excel spreadsheet templates for small business owners to use. These templates are FREE and are capable of managing basic business, small business accounting, sales tax, and financial statements.

It is an excellent introduction to using an online resource, but it lacks several resources you may need as your business grows.

It’s not easy for me to do my books. Should I use a bookkeeping service?

If you are having issues keeping your business accounting straight, you can choose between hiring a bookkeeper and downloading software.

A bookkeeper will probably be more expensive but might give you a feeling of the “personal touch.”

On the other hand, the bookkeeping service will provide accounting software and order of bank statements, expenses, accounts, and taxes at any time, day or night, for a set fee.

Bookkeeping services for small businesses

Finding a bookkeeping service for your business is simple and you can search for one on google, but finding the right one, however, takes a little bit of work.

Finding software through Google

At any point, you can search google for accounting software. Type in “Accounting Software.” Add any keywords you feel are important to the search.

The cost of bookkeeping services for small business

Human bookkeepers rates vary depending on the business size, industry, and financial services needed. In-house bookkeepers can charge anywhere from $18-$23 per hour, with variations depending on experience. Outsourced bookkeepers can be another solution with monthly bookkeeping fees starting from $99 per month

If you’re a small business that only needs basic bookkeeping, a free trial of accounting software should be more than enough to manage your needs.

Once your needs advance service like QuickBooks will charge $25/month between its simple package and $180/month for its advanced services. Depending on how much money your business is handling, you can decide what level of coverage you need.

Conclusion

The options when it comes to bookkeeping are numerous, and many excellent options exist. You should choose your option based on ease of use, cost, and services.

Online services cover all three of those criteria. Spend some time researching the right service for you. Do you need help handling cash flow? Sales tax? Payroll? Income?

The right program exists for you, and all you need to do is check your search engine for it.