Uncover how you can keep track of invoices in Excel for easy finance handling.

Handling finances well is a must for all businesses. Tracking invoices is a big part of this. Doing it manually can be tough. But there’s an easy solution – Microsoft Excel.

We will delve into the systematic use of Excel to monitor and manage your invoices, simplifying your bookkeeping and bringing higher precision to your fiscal affairs.

Benefits of Efficient Invoice Management

Being a business owner means dealing with invoices. You have to create invoices, track payments, and make sure everything adds up.

But what if there was a tool that could make this process even simpler? Consider the benefits of a receipt tracker app. Such an app could digitize your receipts and invoices, making them easier to organize and track. It could even integrate with Excel to streamline your financial management process further.

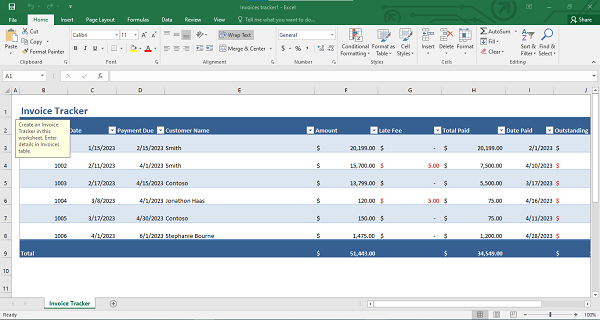

Back to Excel, an invoice tracker template in Excel can make your life much simpler. With an invoice tracker, you won’t have to spend hours creating invoices. Instead, you can just pop the data into the template.

The template will then calculate everything for you. This means you have more time to focus on growing your business.

Having a record of all your invoices in one place can save you from headaches. For example, if a customer disputes an invoice amount, you can easily check your tracker.

An invoice tracker template in Excel can help you see unpaid invoices at a glance. With just one look at your Excel tracker, you can see which customers are late on payments. This means you can take action sooner. For instance, you might decide to send automated reminders to nudge your customers.

You can see incoming payments and outgoing payments. You can also see recurring payments. All these details can help you plan your business budget. After all, a good cash flow can help your business thrive.

Challenges in Manual Invoice Tracking

Firstly, creating invoices manually takes a lot of time. You have to write down all the necessary information. This includes the invoice number, the client’s details, the hours worked, and the total amount. But with an Excel template, you can create invoices fast. Just input the details, and hit enter. The invoice is ready.

Secondly, keeping track of payments can be tough too. You need to know who has paid and who hasn’t. You also need to check the due dates. This means you have to go through each invoice, one by one.

But if you track invoices in Excel, you can see the status of all payments at once. This is much quicker and simpler.

Thirdly, you might make mistakes. Everyone does. For instance, you might mix up invoice numbers. Or you might enter the wrong due date. Such errors can lead to confusion.

They can also cause disputes with clients. However, with an Excel template, you can minimize mistakes. Excel helps you be accurate and precise.

Fourthly, manual tracking makes it hard to send invoices on time. You might forget to send one. Or you might send it late. This can delay payments. But with Excel, you can automate this task. Excel can even calculate the sales tax for you. This way, you can send invoices promptly.

Introduction to Using Excel for Invoice Tracking

Why Choose Excel?

Excel is easy to use. You can quickly learn to track payments, calculate totals, and more. Excel is versatile. You can customize it. You can add columns, change colors, or anything else you want. This way, you can track invoices in Excel how ever you want.

Another good thing about Excel is its templates. There are invoice templates and Excel templates you can use. These make your job easier. You just have to input the details. These include the invoice number, invoice date, and the amount. Then, Excel will do the rest.

Key Excel Features for Invoice Tracking

There are many Excel features that can help you. One of these is the spreadsheet. It’s like a big grid where you can input data. Each box in the grid is a cell. You can input any data you want into each cell. For example, you might input the client’s name, the invoice number, or the due date.

Another feature is the formula. You can use this to do calculations. For instance, you can add up all the payments to see your total income.

You can also calculate the total amount for each invoice. To do this, just input the following formula and hit enter. Excel will calculate everything for you. This is why Excel is a great tool for invoice tracking.

Finally, you can also download free templates. These come with everything you need. They have a place for the invoice number, the client’s details, and the payment terms. You just have to fill in the blanks. Your invoice is ready. You can then track payments, check the status of invoices, and manage your cash flow.

Setting Up Your Excel Spreadsheet for Invoice Management

Creating an Invoice Tracking Template

Do you know what is a template? It’s like a pre-made pattern. You fill in the blanks, and you’re done. In our case, it’s an invoice template you can use over and over.

Open Microsoft Excel and create a new file. You’ll see a blank spreadsheet. Think of this as your canvas. You’re going to paint it with data.

So, what data do you need for invoice tracking? You’ll need things like invoice number, date, and payment status. Add a column for each of these. Now, you have your basic invoice template.

But what if you want a ready-made template? Just click on ‘File’ and then ‘New’. You’ll see a bunch of free Excel templates. Pick an invoice template you like and download it.

Utilizing Excel’s Data Validation Feature

This helps you make sure all your data is correct. It’s like a super smart friend who checks your work. Here’s how it works.

Click on the cell you want to validate. Then, go to ‘Data’ and then ‘Data Validation’. You can set rules for the cell. For example, if you’re tracking payments, you can set the rule to be ‘Number’. This way, you can only enter numbers in that cell.

Excel will warn you if you try to enter anything else. So, you won’t accidentally enter a word when you should enter a number.

You can also use Data Validation for dates. For example, you can make sure all dates are in the future. Or, you can check that no date is more than 30 days away. In short, Data Validation helps you keep your data clean and correct. And that’s crucial when you track invoices in Excel.

Adding and Managing Invoices in Excel

Entering Invoice Data

So, you have your template. Open your invoice template in Microsoft Excel. Look at your columns. You’ll see headings like ‘Invoice Number’, ‘Date’, and ‘Payment’.

Now, for each invoice, fill in the details. For instance, type in the invoice number, the date, and the payment status. You need to include details about your client. You can type in their name and the company they work for.

Remember to be accurate when entering data. For instance, ensure you’ve entered the right invoice number and date. These details are very important.

Updating and Maintaining Invoice Records

When you add invoices, you also need to keep them up to date. Keeping track of invoices means you should know which ones are paid and which ones are not. So, always update your invoice records.

For example, when a client pays, change the ‘Payment’ status from ‘Due’ to ‘Paid’. Also, you may need to add new invoices regularly. That’s no problem. Simply add a new row in your Excel template and fill in the details.

What about if a client is late with a payment? You can use its ‘Conditional Formatting’ feature. This will change the color of a cell if a payment is overdue. So, you’ll know at a glance which invoices need your attention.

Using Excel Functions for Better Invoice Management

Excel is not just a simple sheet where you list down your invoices. It has functions that can make invoice management easier.

Useful Excel Functions for Invoice Tracking

There are several functions that can help you track invoices in Excel. One of them is the ‘SUM’ function. This adds up all the numbers in a selected range. For instance, you can use it to calculate the total of all your paid invoices.

Another useful function is ‘COUNTIF’. This counts the number of cells that meet a certain condition. For example, it can count how many invoices are overdue. To use it, you simply write ‘COUNTIF(range, criteria)’. Here, ‘range’ is where you want to look. And ‘criteria’ is what you’re looking for.

‘VLOOKUP‘ is also a great tool. It finds things in a table or a range by row. For instance, you can use it to look for a specific invoice in your list. This can save you a lot of time.

Automating Invoice Management Tasks

Did you know that Excel can automate some tasks for you? You can use it to automatically track payments, calculate totals, and even send reminders for overdue invoices.

In fact, you can even go beyond just invoices. It’s possible to leverage Excel to process other financial documents such as receipts. For instance, you can follow the receipts to Excel guide to streamline your receipt management.

Getting back to invoices, how does Excel do automation? It uses something called ‘Macros’. These are like mini-programs that do tasks for you. For instance, a Macro could automatically highlight invoices that are overdue. Or it could calculate the total amount you’ve invoiced for a certain period.

Automating tasks can save you a lot of time.

FAQ

What if I want to explore options beyond Excel for invoice management?

If you’re looking to diversify your invoice management tools, you may want to consider some of the best software for managing invoices which are specifically designed for invoice handling and can seamlessly integrate with your existing financial systems.

Can Excel handle money from other countries in invoicing?

Excel can do the math to turn money from other countries into your own money. You just need to tell Excel the exchange rate.

Can Excel talk to other money managing programs?

Excel can share information with lots of other programs that help manage money. This means you can move data back and forth easily. So, using Excel can help you keep on top of your finances.

Will my data be safe in Excel?

Excel has ways to keep your data safe. You can protect your files with a password. And you can also encrypt your files. Encryption turns your data into a secret code, which helps keep it safe. Just remember, always back up your data and follow good cybersecurity habits.

Is it possible that more than one person work on the Excel spreadsheet at the same time?

If you’re using the right version of Excel, yes. Excel for Microsoft 365 lets lots of people work on a spreadsheet together. This is great for teamwork and let’s keep everyone on the same page.

Wrapping Things Up

Keeping track of invoices is super important for your business. And Excel can help a lot. It makes making and managing invoices simpler. Plus, you can use Excel to keep an eye on payments. And the best part? Excel can do some jobs automatically.

Collect receipts from your email automatically!

Try WellyBox - your AI assistant for receipts